Candid Insights

Exploring the latest trends and stories that shape our world.

Comparing Insurance: Why Paying More Doesn't Always Mean Better Coverage

Discover why higher insurance premiums don't guarantee better coverage. Uncover the secrets to smarter, cost-effective insurance choices!

The Truth About Insurance Premiums: Are You Paying for Peace of Mind or Just Overpriced Coverage?

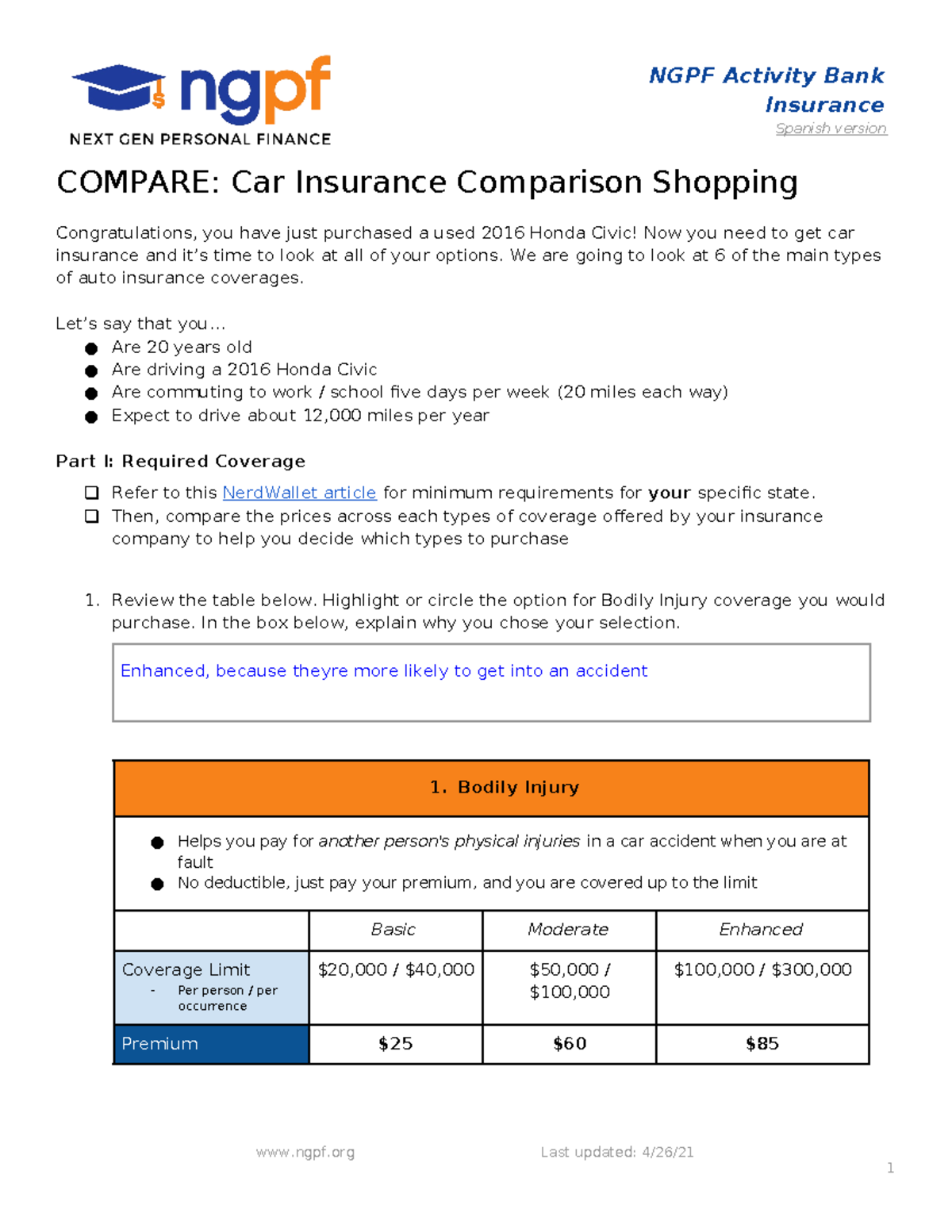

When it comes to insurance premiums, many policyholders often find themselves wondering if they're truly paying for peace of mind or simply settling for overpriced coverage. While it's easy to be lured in by low initial premiums, the reality behind these costs can be far more complex. It's essential to understand that your premiums are calculated based on various factors, including risk assessment, the type of coverage, and your personal details such as age, health, and occupation. Before committing to a policy, individuals should carefully evaluate their needs and avoid being swayed by captivating advertisements that promise exceptional benefits without clarifying the underlying costs.

As you navigate the world of insurance, consider performing a thorough comparison of different providers to uncover potential discrepancies in pricing and coverage options. An informed decision often leads to significant savings. Keep in mind that cheap does not always mean good; sometimes, the lowest insurance premiums may indicate limited coverage and higher out-of-pocket expenses when it matters most. By educating yourself and asking critical questions, you can ensure that you don't just purchase a policy but invest in a plan that truly provides the protection and peace of mind you deserve.

Understanding Coverage Gaps: Why Cheaper Isn’t Always Inferior

Understanding coverage gaps in insurance policies is crucial for consumers seeking the best value for their money. Often, individuals are drawn to cheaper insurance options, believing that they can save significant amounts on premiums. However, this approach can lead to coverage gaps that leave them vulnerable in times of need. For instance, a lower-cost plan may not include essential features like personal property protection or liability coverage, which are critical components in safeguarding against unforeseen circumstances. Evaluating the full extent of a policy's coverage is essential to ensure security without compromising on quality.

Moreover, opting for less expensive insurance can sometimes result in inadequate customer support and slower claims processing. Coverage gaps are not always apparent until it's too late, and clients might find themselves stuck with hefty out-of-pocket expenses when faced with a claim. Consider comparing policies not just based on price, but also on customer reviews, support availability, and the specific inclusions each policy offers. Prioritizing comprehensive coverage over low costs can lead to greater long-term savings and peace of mind, ensuring that you are adequately protected when you need it most.

Myth vs. Reality: Does a Higher Premium Guarantee Better Protection?

When it comes to insurance, many consumers subscribe to the notion that a higher premium guarantees better protection. This belief often stems from the assumption that increased costs correlate directly with enhanced coverage and higher claim payouts. However, the reality is much more nuanced. A higher premium may indeed provide access to more comprehensive policies or additional benefits, but it does not necessarily guarantee superior financial protection in every case. Policies can vary widely in their terms, exclusions, and limits, meaning that thorough research is essential to determine whether you’re genuinely getting better coverage for your investment.

Furthermore, it is crucial to evaluate what you're paying for rather than focusing solely on the premium amount. For instance, lower-premium options may include essential coverage that can sufficiently meet your needs without the bells and whistles that inflate costs. Additionally, factors such as your location, individual risk factors, and the specific insurance provider can significantly influence both premium costs and coverage quality. Understanding the myth versus reality of insurance premiums is essential to making informed decisions and ensuring that you receive the most appropriate protection for your unique situation.