Candid Insights

Exploring the latest trends and stories that shape our world.

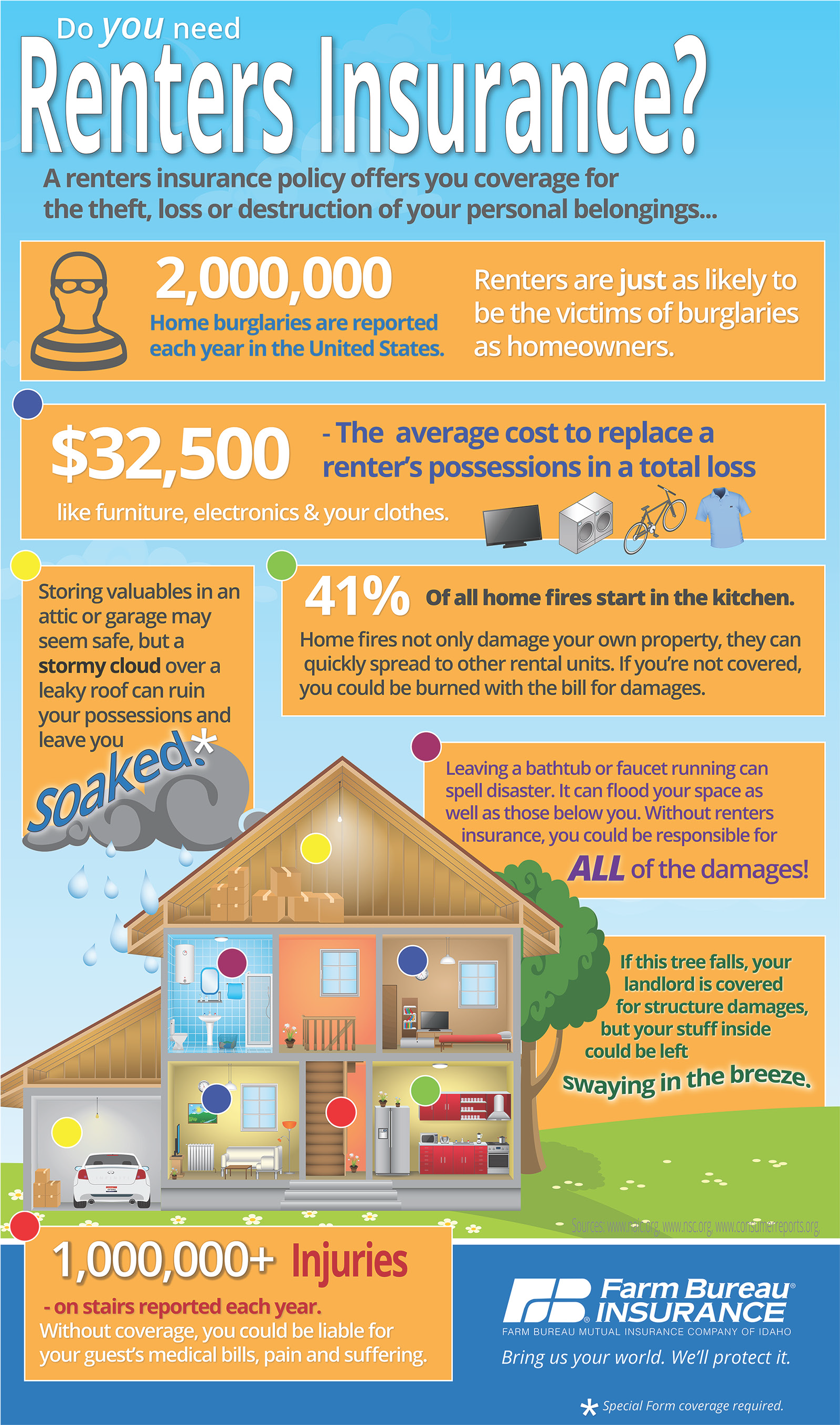

Renters Insurance: The Secret Weapon for Stress-Free Living

Unlock peace of mind with renters insurance! Discover how this secret weapon can transform your living experience today.

Understanding Renters Insurance: Essential Coverage for Your Peace of Mind

Understanding renters insurance is crucial for anyone living in a rented space, whether it’s an apartment, condo, or house. This type of insurance provides essential coverage for your personal belongings in the event of theft, fire, or other disasters. According to the National Association of Insurance Commissioners, renters insurance not only protects your possessions but also offers liability coverage, which safeguards you against legal claims resulting from accidents that may occur within your rented home. Consider the peace of mind that comes from knowing your valuables are protected, allowing you to focus on enjoying your living space.

Moreover, renters insurance is often surprisingly affordable, making it a wise investment for anyone renting a home. Policies typically offer a range of coverage options, allowing you to customize your plan to fit your needs and budget. For more detailed information on how to choose the right policy, visit Consumer Financial Protection Bureau. Understanding the nuances of renters insurance can help you make informed decisions and truly enjoy the security and peace of mind that comes with knowing you are protected.

Top 5 Reasons Why Renters Insurance is a Must-Have for Every Tenant

Renters insurance is often overlooked by tenants, but it is an essential form of protection that everyone should consider. One of the top reasons is financial security. In the event of theft, fire, or other disasters, renters insurance can help tenants recover their belongings. According to the Nolo, this type of coverage typically includes personal property protection, liability coverage, and additional living expenses. This means that renters are not left to foot the bill for unexpected losses or damages out of their own pockets.

Another compelling reason to invest in renters insurance is the liability protection it provides. If a guest is injured in your rental unit, you could be held financially responsible for their medical expenses. With renters insurance, you have liability coverage that can help cover these costs. Furthermore, some policies may also include coverage for damages that you accidentally cause to the property, offering an extra layer of financial defense. For more details on the benefits of liability coverage, check out Insure.com.

What Does Renters Insurance Actually Cover? A Comprehensive Guide

Renters insurance is a crucial safeguard for anyone renting a home or apartment. It typically covers your personal belongings in the event of theft, fire, or water damage. While specific policies can vary, most renters insurance policies provide coverage for items such as furniture, electronics, clothing, and more. According to the National Association of Insurance Commissioners, renters insurance often protects against perils like vandalism, smoke damage, and even certain types of natural disasters. To fully understand what your policy covers, it’s essential to review the declarations page and any exclusions that may apply.

Additionally, renters insurance usually includes liability coverage, which protects you if someone gets injured while visiting your rented space. This coverage can help cover legal fees and medical expenses if a lawsuit arises. Many policies also offer additional living expenses (ALE) coverage, which can help pay for temporary housing and living costs if your rented home becomes uninhabitable due to a covered loss. To learn more about the ins and outs of renters insurance, visit Insurance Information Institute for detailed guidance and resources.