Candid Insights

Exploring the latest trends and stories that shape our world.

Crypto Chaos: Understanding the Twists and Turns of Market Volatility

Dive into the wild world of crypto! Unravel market volatility and discover how to ride the waves of change like a pro.

What Factors Contribute to Cryptocurrency Market Volatility?

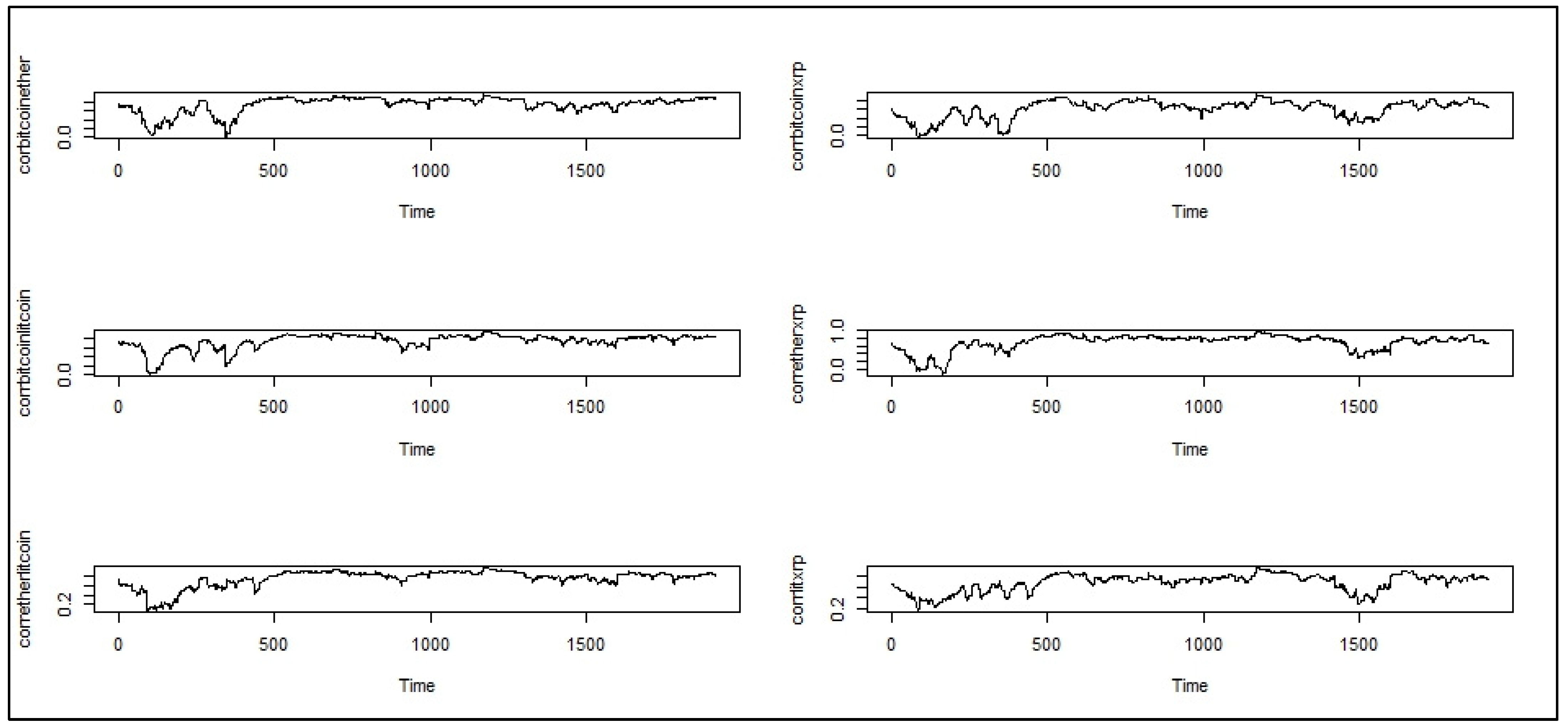

The volatility of the cryptocurrency market is influenced by a myriad of factors, making it one of the most unpredictable sectors in finance. One of the primary drivers is market sentiment, which can change rapidly due to news, events, or social media trends. Sudden announcements, regulatory changes, or partnership agreements can cause significant price fluctuations. Additionally, the relatively low market capitalization of most cryptocurrencies compared to traditional assets means that even small trades can lead to large price swings, amplifying the overall volatility.

Another crucial element contributing to cryptocurrency market volatility is the lack of liquidity in certain coins. While major currencies like Bitcoin and Ethereum generally have higher trading volumes, many altcoins do not enjoy the same level of trading activity. This lack of liquidity can lead to sharp price movements when large buy or sell orders are executed. Furthermore, external factors such as geopolitical developments, technological advancements, and competition from other cryptocurrencies also play a significant role in shaping market sentiment and influencing price stability.

Counter-Strike is a popular tactical first-person shooter game that pits two teams against each other: the terrorists and the counter-terrorists. Players engage in various game modes, from bomb defusal to hostage rescue, showcasing teamwork and strategy. For those looking to enhance their gaming experience, there's a cloudbet promo code that can provide some exciting bonuses.

How to Navigate the Highs and Lows of Crypto Trading

Cryptocurrency trading can often feel like riding a roller coaster, with its unpredictable market fluctuations and sudden price swings. To effectively navigate the highs and lows of crypto trading, it's essential to develop a solid understanding of market dynamics. Begin by educating yourself about the various cryptocurrencies and their unique behaviors. This foundational knowledge will not only help you make informed decisions but also build your confidence to embrace the inevitable ups and downs. Consider creating a detailed trading plan that includes your investing goals, risk tolerance, and strategies for both bullish and bearish market conditions.

In addition to a solid trading plan, implementing effective risk management strategies is crucial for navigating the turbulent crypto market. Always diversify your portfolio to mitigate risks and avoid putting all your assets into one cryptocurrency. One practical approach is to use tools such as stop-loss orders to help protect your investments during downturns. Remember to stay updated on market news and trends, as these often influence price movements. Engaging with online communities, reading expert analyses, and following market indicators can provide valuable insights. By combining knowledge with strategic planning, you can better manage the emotional highs and lows of crypto trading.

Understanding Market Sentiment: The Psychology Behind Crypto Fluctuations

Understanding market sentiment is crucial for anyone involved in the cryptocurrency space. The fluctuations in crypto prices are often driven more by human psychology than by underlying fundamentals. Investors' emotions—fear, greed, and certainty—collectively dictate market trends and price movements. For instance, the FOMO (Fear of Missing Out) can lead to sudden price surges as traders rush to buy in, while panic selling during market corrections can cause rapid declines. By analyzing social media trends and news reactions, one can gain insights into the prevailing sentiment and make informed trading decisions.

Furthermore, understanding market sentiment involves recognizing key indicators that reveal the mood of the market. Sentiment analysis tools can gauge the emotions behind social media posts, news articles, and forum discussions about cryptocurrencies. Surveys and polls are other essential methods, providing a quantitative measure of investor confidence. Moreover, acknowledging historical data, such as the impact of major events on market sentiment and prices, can help predict future fluctuations. In conclusion, mastering the psychological aspects behind crypto fluctuations allows traders to better navigate this volatile market and make strategic decisions that align with prevailing sentiments.